Why you may want to consult with an MSP about cybersecurity before you fill out a cyber liability inurance questionnaire

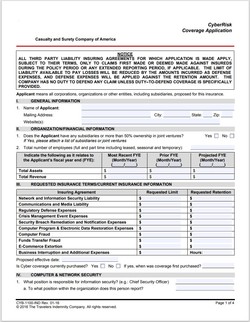

You may want to consult with a managed service provider (MSP) specializing in Cybersecurity before filling out a cyber liability or cyber breach insurance questionnaire because this is where mistakes count.

Increased cyber breaches and Ransomware losses have significantly impacted how insurance carriers have reacted to paying out on those claims.

Insurance carriers have increased their premiums almost unilaterally as they examine loss-run data from the prior years for cyber insurance policy losses. The increased premiums account for the increased risk and potential for significant losses that seem to mount almost daily. This makes cyber insurance more expensive for businesses, which may lead some companies to reevaluate their risk management strategies because, besides the increase in premiums, you may not get your claim approved if you have a loss.

We've noticed that insurance carriers have adjusted their underwriting standards to be more selective in the risks they are willing to cover, potentially making it more difficult for some businesses to obtain cyber insurance as carriers are imposing stricter cybersecurity requirements for policyholders to reduce the likelihood of a breach or ransomware attack occurring in the first place.

Being careless when filling out a cyber liability insurance policy questionnaire is most certainly a bad idea because it may result in the business being underinsured, not having enough coverage in place, worse is Inaccurate or incomplete information, which can affect the insurance provider's assessment of the business's risk, which can result in higher premiums, more exclusions or limitations in coverage, or even denial of coverage altogether. In addition, it may indicate to the insurance provider that the business is not taking cybersecurity seriously and have your application declined.

The carrier will most likely perform a forensic analysis of the breach or attack in the event of a breach. Suppose they find that you had misrepresented cybersecurity controls in place when you filled out the application for the policy or overstated protections. In that case, you could stand to have your claim declined altogether for material misrepresentation.

Here are some of the reasons why consulting with an MSP that specializes in cybersecurity before filling out a cyber liability or cyber breach insurance questionnaire is a good idea:

-

Technical Expertise: Cyber liability insurance questionnaires often contain technical language and terms unfamiliar to small business owners or employees. An MSP specializing in cybersecurity can provide the technical expertise to understand the questions and provide accurate answers.

-

Assessing Cybersecurity Readiness: An MSP specializing in cybersecurity can help small businesses assess their cybersecurity readiness before completing the questionnaire. This can help identify gaps or weaknesses in the business's cybersecurity posture, which can be addressed before completing the questionnaire.

-

Customized Solutions: An MSP specializing in cybersecurity can provide customized solutions to meet the business's needs. This can ensure the business has the necessary cybersecurity measures to meet the cyber liability or cyber breach insurance questionnaire requirements.

-

Compliance Requirements: Cyber liability insurance questionnaires often require businesses to meet specific compliance requirements, such as the Payment Card Industry Data Security Standard (PCI DSS) or the Health Insurance Portability and Accountability Act (HIPAA). An MSP specializing in cybersecurity can help businesses understand and meet these compliance requirements.

-

Reduce Risk: Consulting with an MSP specializing in cybersecurity before filling out a cyber liability or cyber breach insurance questionnaire can help businesses reduce their risk of a cyber-attack or data breach. The MSP can identify any vulnerabilities or weaknesses in the business's cybersecurity posture and provide solutions to these issues.

In conclusion, consulting with an MSP specializing in cybersecurity before filling out a cyber liability or cyber breach insurance questionnaire can provide the technical expertise, customized solutions, compliance requirements, and risk reduction needed to ensure that the questionnaire is completed accurately and completely. This can help small businesses obtain the cybersecurity insurance coverage they need to protect against the financial losses asSOCiated with a cyber-attack or data breach.